Dear Finbloxers,

We're happy to provide our sixth monthly Transparency Report, which is designed to bring some peace of mind to our users so that they know where their funds are being deployed. The allocations presented below are subject to change depending on strategy performance, future yield projections, and the evolution of the customer deposit mix.

Markets

Our glimmer of hope in crypto asset price recovery near the end of October turned out to be massively optimistic, as FTX failed shortly after. This has also impacted other platforms such as Blockfi (which officially filed for bankruptcy this week), Gemini Earn, and Genesis Earn. There are probably others that have been materially affected - but they have not yet made any announcements. Additionally, market-making activity has decreased leading to wider spreads, less market depth, and more price volatility. Speculation on the solvency of other exchanges continues.

Finblox had zero customer exposure on FTX, Blockfi, Genesis, or Gemini. In fact, we've had near-zero exposure of customer assets to any CEX or CeFi platform even prior to FTX’s halting of withdrawals. We don’t believe the market stresses and bankruptcies in the space are over either, as FTX managed to seem solvent for 6 months after the UST/LUNA crash.

DeFi Allocation Increase & Risks

All current customer assets are in DeFi protocols or self-custody. There is more in self-custody than we would like, but some assets have been very hard to place at attractive rates that don't have unreasonable levels of risk. While DeFi has performed well during market stress, that doesn’t mean it is a risk-free environment. Hacking and exploits remain a significant risk. We target relatively high TVL projects and protocols, and diversify exposure to the extent possible.

November Yield Changes

We had to reduce the yields on several assets in November due to our elimination of exposure to CEX margin strategies. For many of these crypto assets, the only remaining options for placement are liquidity pool (”LP”) token pairs, which exposes users to impermanent loss (unfortunately there is no space for further discussion on IL risk here). We’d rather have users withdraw unproductive assets than take on IL risk with volatile crypto asset pairs, even if the APYs seem high. Unfortunately, we expect to reduce more rates in December.

On the positive side, we were able to raise ETH & AXS rates.

Target Allocations

We’ve made significant re-allocations in November for the reasons explained above. We have no plans to re-enter any CEX margin lending strategies in the foreseeable future and will further allocate to DeFi strategies. We will have temporary exposure to CEXs due to our need to occasionally bridge an asset between protocols. For example, we offer users the ability to deposit and withdraw USDC via Ethereum, BSC, and Polygon networks. This requires us to use CEXs as a bridge. Typically, the exposure lasts no longer than a few hours.

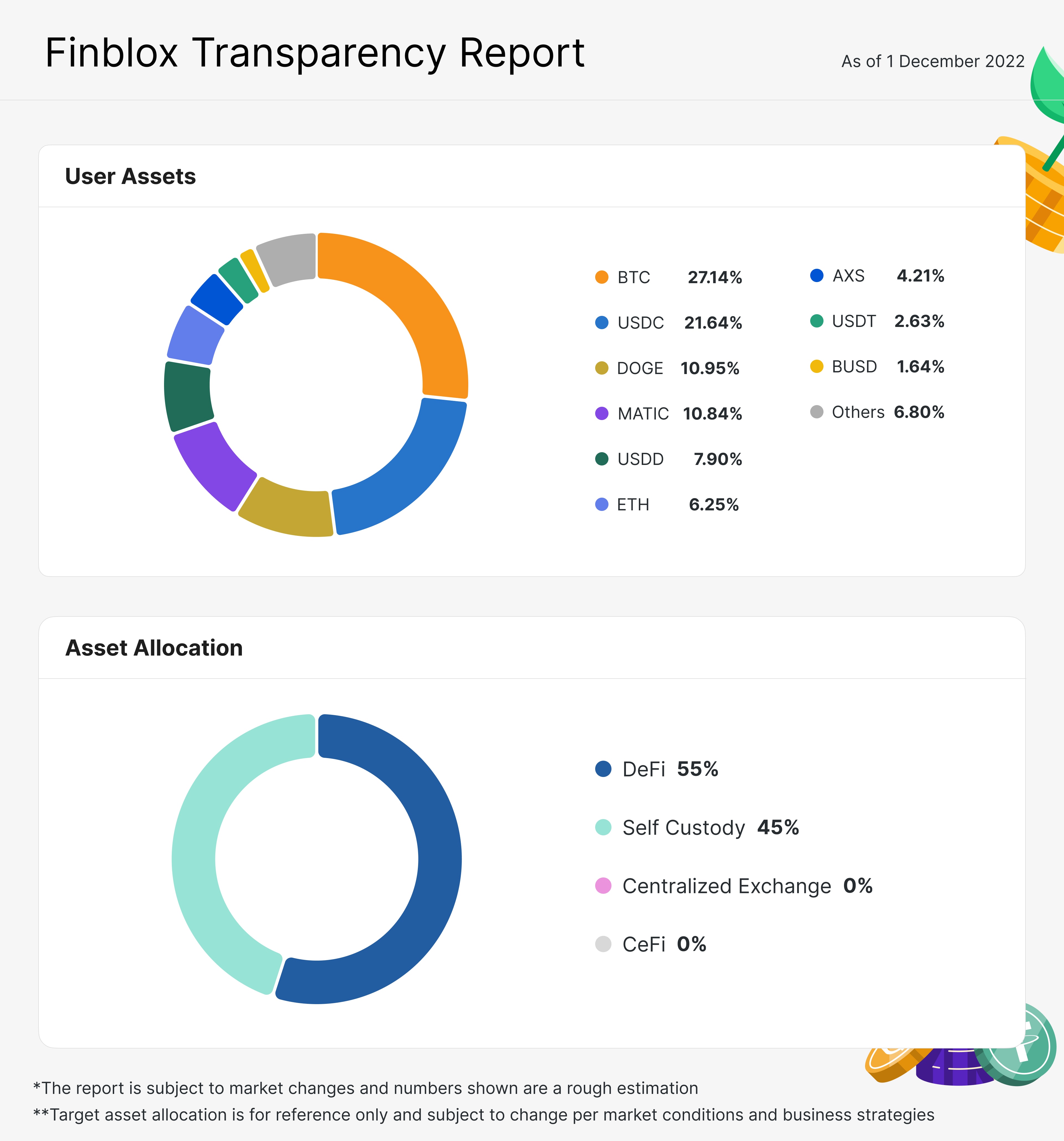

Our target allocations for customer assets that were originally set in July have changed due to market developments and are now as follows:

- DeFi protocols: 40-90%

- Centralized exchange (CEX): 0-5% (used for temporary asset bridging between networks, ie USDC_ETH → USDC_POLY)

- Self custody: 5-15%

- CeFi platforms: 0%

As of the end of November, our allocations are as follows:

- DeFi protocols: 55%

- Centralized exchange (CEX): 0%

- Self custody: 45%

- CeFi platforms: 0%

We believe in providing transparency to our users on the company's activities and aim to increase our users’ view of where their coins and tokens are and how they are performing. As always, we'd love to hear more feedback about the types of info you want. There are more exciting plans for December, so stay tuned!

All the best,

The Finblox Team