Learn about the differences between traditional and decentralized finance, the mechanics of inflation, and why crypto can help!

Mainstream media often paints a polarizing narrative of cryptocurrency versus banks, in an all-out war involving regulations, investor protections, and concerns over cybercrime. The most hardcore proponents of decentralized finance argue that there is no need for an overseeing body, and that people should be able to take financial matters into their own hands with the utmost speed, security, and privacy. Meanwhile, regulatory authorities such as the SEC are relentless in hammering home the idea that cryptocurrency is dangerous, unpredictable, and unfit to act as a reliable store of value.

In truth, cryptocurrency has not evolved to a point where it can stand alone without the assistance and trust built over hundreds of years by established institutions - and traditional finance is not equipped to tackle the problems of tomorrow without implementing drastic technology changes that would rattle the entire system as we know it.

No one likes uncomfortable change - especially not the big conglomerates that have spent billions of dollars to lobby and profit from the current system! However, sometimes change and growing pains are necessary to realize a better future. To accomplish this, both traditional and decentralized finance sectors need to work together to provide the necessary consumer education and drive adoption of hybrid solutions.

What are the strengths of banks?

- The most obvious advantage of banks is that they provide physical custody of your assets - so that you don't have to stash dollar bills underneath your pillow! Banks feature some of the most sophisticated security and fail-safe systems in the world, and in the highly-unlikely event that a vault has been breached - any legal tender that has been stolen can easily be replenished through printing.

- Your assets are also federally-insured in the event of theft, catastrophe, and other misfortunes. Limits may vary by country, but the FDIC insures up to $250,000 worth of cash per account. If you own larger sums of money, you can distribute your cash across multiple accounts for maximum coverage.

- When it comes to depositing, withdrawing, and exchanging currencies - there is far greater liquidity in the traditional fiat system than there is in cryptocurrency. To put it simply, more people use cash! The value of the dollar wouldn't even blink if you traded a billion USD for Japanese yen, but if you attempted the same transaction in Bitcoin - the markets would definitely feel the waves. And in smaller cap cryptocurrencies, you might not even be able to trade such an amount due to the limited number of buyers and sellers.

- Legal tender is accepted everywhere. Cash is king, and not all places in the world will have the technology set up to accept digital asset payments or even credit cards!

- Although less common, banks can still offer unsecured personal loans based on your credit history that require no collateral. This can be extremely helpful in the event of emergencies, or getting out of a tight financial spot. Crypto lending almost always requires collateral to be set against the value of the loan - and it is usually overcollateralized to account for the volatility of crypto. This means you have to put up more than the value you are borrowing to receive the loan.

- Despite high volumes of traffic, customer support at banks is quite well-built out and vastly superior to the support you would receive from a centralized exchange. Decentralized exchanges don't even offer human support due to the 100% automated nature smart contracts!

What are the weaknesses of banks?

- One major flaw of the banking and fiat system is that it is overly-reliant on the US dollar, the most powerful currency in the world. The US dollar makes up over 60% of all foreign exchange reserves. This creates a chain of unhealthy dependencies, and sometimes disastrous destabilization of other currencies when there is a significant event that affects the US economy.

- Transaction processing times can take days or even weeks to complete, especially in the case of international transfers.

- Bank penetration is low in developing economies, limiting accessibility and financial inclusion.

- Fees for account maintenance and wire transfers can be extraordinarily high, and overdraft fees are by far the biggest source of revenue for banks.

- Although banks are supposed to follow strict guidelines and criteria for offering services to customers, they are frequently prone to human error and even discrimination. Appearances can make all the difference between prompt customer service and approvals, or rejection.

- Privacy and data leakage to 3rd party advertisers is a practice frequently carried out by big banks. Be careful to read the fine print in your disclosures before signing.

- Foreign exchange rates place citizens of certain countries at a disadvantage, especially when traveling abroad. However, this has larger implications for international trade; an undervalued currency relative to another will cause higher prices for imports and lower the value of exports. In nations with limited natural resources or manufacturing capacity, this could cripple the economy.

- National banks place limits on how much money you can move across borders. This creates problems for relocation and mobility.

- Finally, banks offer extremely low interest rates in exchange for the ability to borrow the money that you deposit, and lend it out. The average bank interest rate in a savings account is a measly 0.06%, compared to the 16-24% borrowing rates they charge consumers. This is a huge problem, as inflation rates easily exceed this amount and erode the value of your funds every year.

Why is inflation such a big problem?

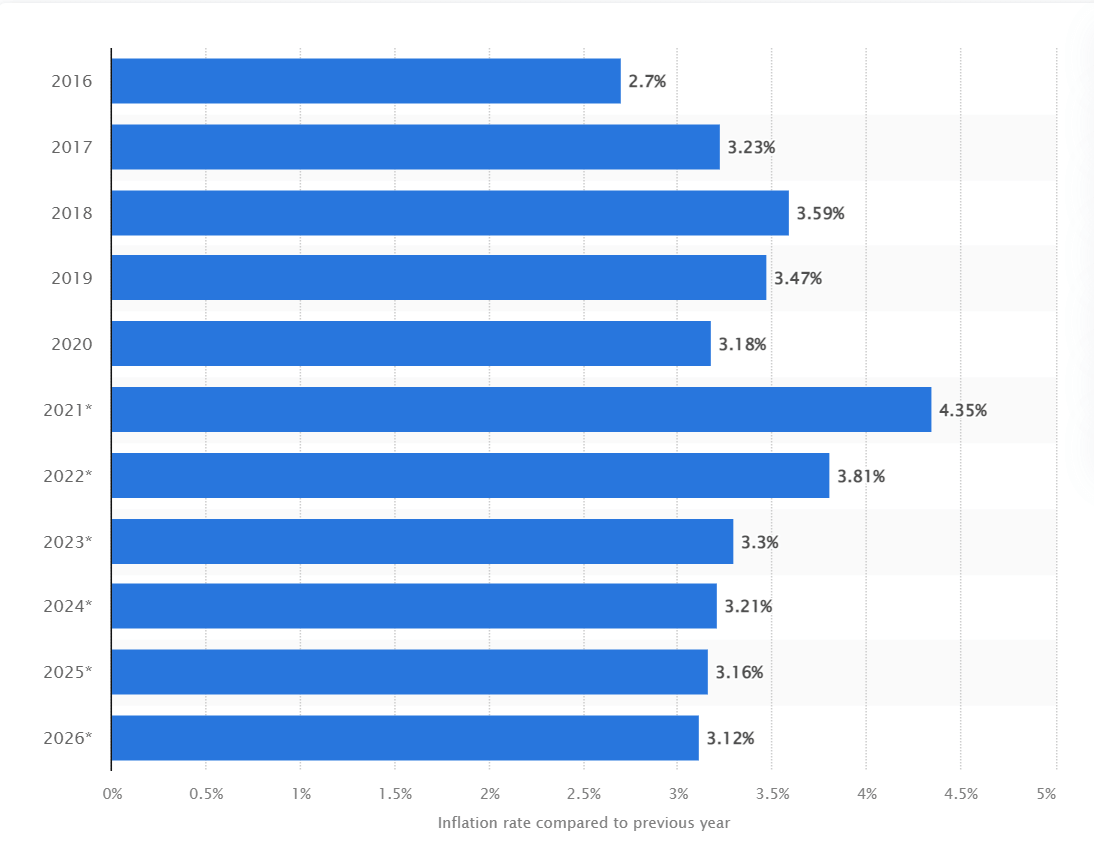

The average worldwide rate of inflation in 2021 was 4.35%, and is projected (hopefully) to decrease to 3.81% by the end of 2022. However, these numbers are not indicative of how badly inflation impacts developing economies. For example, Venezuela topped the list at a staggering 1198% - while Syria, Sudan, and Lebanon all experienced inflation rates from 100-300%.

In certain countries, inflation is so bad that the price of goods changes every single day. Shopkeepers do not bother to tag their items, and instead request that their customers inquire about the price directly. Thieves and robbers have been known to completely neglect cash as loot, as noted in the bizarre case of Venezuelan robbers refusing to steal bolivars (their national currency) because they were so worthless at the time.

But for the average middle-economy individual - inflation has four primary reductive effects:

- The price of goods increases

- The purchasing power of the dollar or underlying currency decreases

- The borrowing interest rate from banks and financial institutions increases

- The value of your savings erodes over time

To understand why these effects take place, let us examine the underlying causes of inflation. The first type of inflation is demand-pull inflation, which occurs when the demand for goods exceeds the production capacity. This usually happens when an economy is doing extremely well, and the supply of money is in excess. When people have alot of money, they tend to want to purchase more goods! This decreases the supply of goods relative to demand, and the price goes up.

The second type of inflation is cost-push inflation, which occurs when the raw cost of natural resources, components, or manufacturing increases. This drives up the derivative product(s) price as well, since their raw materials have become more expensive to obtain and create. For example, an increase in the price of silicon - which is commonly used in circuits - would drive up the cost of goods in laptops, TVs, washing machines, and virtually anything electronic.

The third and final type of inflation is built-in inflation, which is a response to the internal belief that inflation will continue, and that the price of goods and services will rise. As a result, people request higher and higher wages, develop greater purchasing power - and spend it, driving the cost of goods up yet again in a never-ending cycle.

So what happens when the price of goods increases? The purchasing power of the underlying currency is effectively reduced, as you would need to spend more of it to obtain the same item compared to what you spent before.

One of the ways that governments attempt to combat devaluing of their currencies is by restricting the circulating supply of money, which creates scarcity. If you recall from previous articles, scarcity is what drives the value of something up again. Therefore, federal authorities typically want to discourage the borrowing of money - which would release additional cash reserves into circulation.

How do they accomplish this? They raise the interest rates on borrowing, so that it becomes more expensive for consumers to get loans. Unfortunately, this can create a disastrous effect for individuals and families that need access to emergency capital - but can no longer afford to repay their creditors.

To cap it off, inflation periodically reduces the value of any money stored in your savings accounts. $100 at the start of 2021 would have been worth around $96 by the end of it. Bank interest rates are not sufficient to offset inflation, and this is one of the primary drivers in favor of opening up crypto savings accounts - which we will discuss later.

How does cryptocurrency complement traditional finance?

- Unlike fiat currency, the value of crypto is universal and is not at the mercy of the US dollar or foreign exchange rates. 1 BTC will always be worth 1 BTC, whether you are in Venezuela or the United States.

- Transaction processing times are lightning-fast and complete in a matter of seconds and minutes, with no human intermediaries.

- Mobile device penetration is almost always higher than bank penetration in many countries. Since crypto can be sent by anyone who has a smartphone, there is no need for physical banks or ATMs in peer-to-peer transactions.

- Admittedly, some crypto transaction fees can be pretty high when a network is congested - but as a whole, they cost significantly less than bank transfers. And, there are no yearly fees for account maintenance or overdraft charges in crypto.

- Smart contracts are automatically executed and do not require human intervention, reducing the margin of error to nil unless the programming itself is faulty.

- Data transmission using blockchain technology is far superior in terms of speed, security, and privacy when compared to how banks currently manage data. Remember that information on the ledger is immutable, traceable, and easily accessed for recordkeeping.

- Cryptocurrency transactions are borderless, meaning that there is no technical limit to how much money you can move around internationally.

- Crypto savings accounts and their high interest rates are one of the only remaining ways left to passively combat inflation. The alternative is to actively trade in the markets and expose yourself to short-term volatility, as well as decision-making risk. For cryptocurrency beginners and more conservative investors, this is simply not a chance they are willing to take.

The Takeaway:

Both traditional and decentralized finance have alot of advantages they can offer each other, if they choose to set aside their differences. Crypto adoption can benefit immensely from the trust and endorsement of major financial institutions, as well as reasonable regulations that would make the populace feel safe. Banks, on the other hand - could learn a thing or two from blockchain technology, which would allow them to extend their services to even the most remote and under-served communities.

For those of you who are interested in beating inflation and exploring a high-yield cryptocurrency savings account - Finblox might be the perfect solution for you. Starting today, you can buy and earn amazing yields on your assets by simply depositing and holding them with us! Why risk it all trading in the markets, when you can kick back and wait for the opportune moment to sell?

Thanks for reading! Please subscribe if you haven't already - and stay tuned for our next article, which explain everything you need to know about crypto savings platforms.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. Charts, graphs and references to any digital assets are for informational and illustrative purposes only.